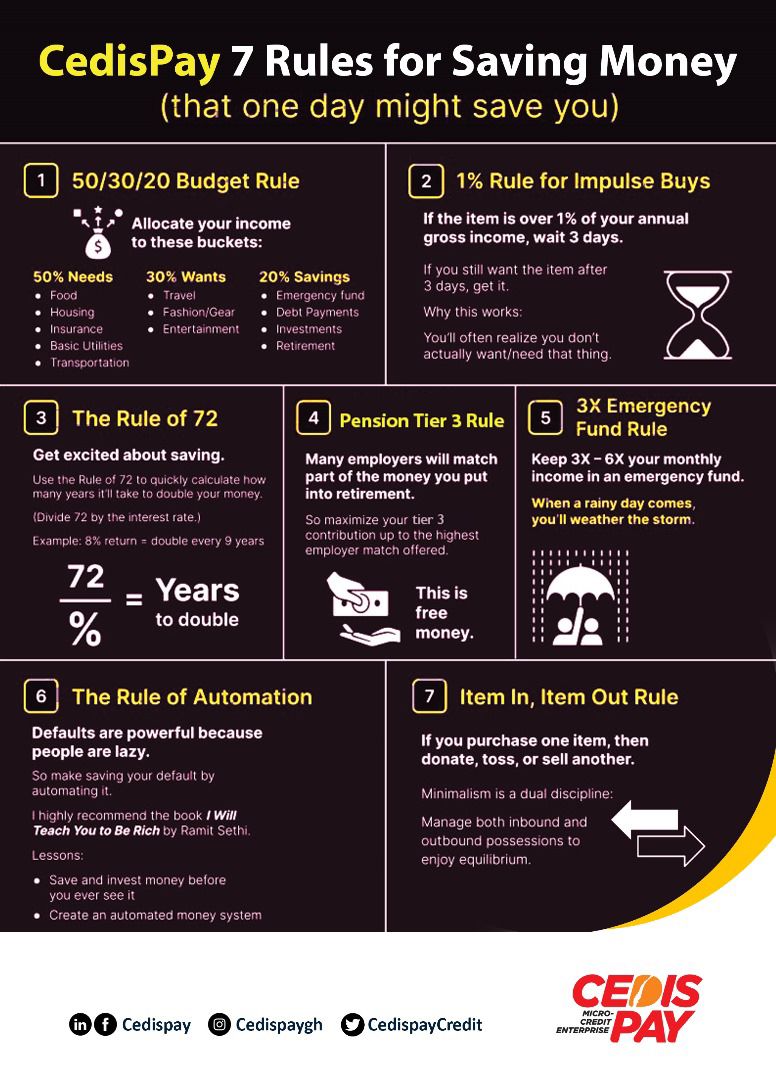

CedisPay's 7 Money-Saving Rules (That Could Save You One Day)

Dear Valued CedisPay Members,

At CedisPay, we are more than just a provider of responsible loans. Our mission is to see you fulfilled as you pursue your financial goals, whatever they may be. In this article, we're excited to share CedisPay's 7 rules for saving money – principles that may one day prove invaluable to your financial well-being.

-

Rule 1 - 50/30/20 Budget Rule: Divide your income into three buckets:

- 50% for needs (food, housing, insurance, utilities, transportation)

- 30% for wants (travel, fashion, entertainment)

- 20% for savings (emergency fund, debt payment, investment, retirement)

How it helps customers: By adhering to this rule, customers can prioritize their spending, ensuring they cover essentials, indulge in some luxuries, and still save for their future financial goals, leading to greater financial stability and peace of mind.

Research Source: According to the Harvard Business Review, individuals who adhere to the 50/30/20 budget rule are more likely to achieve financial stability and accumulate wealth over time. According to a study by the Federal Reserve Bank of St. Louis, individuals who adhere to structured budgeting methods like the 50/30/20 rule are more likely to achieve financial stability and accumulate wealth over time.

Rule 2 - 1% Rule for Impulse Buys: If an item costs more than 1% of your annual gross income, wait 3 days before purchasing it.

How it helps customers: This rule encourages customers to be mindful of their spending habits, helping them avoid impulsive purchases that could derail their budget and instead make intentional spending decisions aligned with their financial goals. Research Source: A study published in the Journal of Consumer Research found that delaying gratification for larger purchases leads to higher satisfaction levels and reduced buyer's remorse, supporting the effectiveness of the 1% rule.

Rule 3 - The Rule of 72: Use the rule of 72 to calculate how long it will take to double your income. Divide 72 by the interest rate to determine the number of years

How it helps customers: Understanding the power of compounding interest empowers customers to make informed decisions about their investments, helping them grow their wealth over time and work towards achieving their long-term financial aspirations. Research Source: Financial experts like Warren Buffett and Albert Einstein have endorsed the Rule of 72 as a quick and effective tool for estimating investment growth potential.

Rule 4 - Tax-Free Savings Rule: Many employers provide matching contributions to your retirement savings. Various countries, such as the US with the 401K and Canada with the RRSP, offer tax-free savings options. In Ghana, where CedisPay currently operates, the Pension Tier 3 system allows for tax-free contributions of up to 16.5% of your income. It's essential to maximize your Tier 3 contributions to take full advantage of this opportunity, as it essentially amounts to free money, especially when considering the highest employer match available.

How it helps customers: By taking advantage of tax-free savings options like Tier 3 pension contributions, customers can maximize their retirement savings while minimizing their tax liabilities, setting themselves up for a financially secure future. Research Source: A study conducted by the World Bank found that tax-deferred retirement accounts, such as Tier 3 pensions, are an effective way to boost retirement savings and reduce tax liabilities.

Rule 5 - 3X Emergency Fund Rule: Keep 3-6 times your monthly income in an emergency fund to weather unexpected financial storms.

How it helps customers: Building an emergency fund provides customers with a financial safety net, ensuring they have the resources to cover unexpected expenses without resorting to high-interest debt, thereby safeguarding their financial well-being. Research Source: Research by the Federal Reserve Bank of St. Louis suggests that having an emergency fund equivalent to at least three months' worth of expenses significantly reduces financial stress and improves financial resilience.

Rule 6 - The Rule of Automation: Make savings automatic by setting up automated contributions, such as Tier 3 pension contributions, to ensure consistency and discipline.

How it helps customers: Automating savings removes the temptation to spend impulsively, helping customers stay on track with their financial goals and build wealth steadily over time, ultimately leading to greater financial security and fulfillment. Research Source: A A study published in the Journal of Economic Psychology found that individuals who automate their savings are more likely to achieve their long-term financial goals compared to those who rely on manual contributions, highlighting the effectiveness of the rule of automation.

Rule 7 - Item In, Item Out: Adopt a minimalist approach to spending by donating or selling an item whenever you make a new purchase.

How it helps customers: Embracing minimalism encourages customers to prioritize their spending on things that truly matter to them, helping them live within their means, reduce clutter, and achieve greater financial freedom and fulfillment. Research Source: The Minimalists, Joshua Fields Millburn and Ryan Nicodemus, advocate for the "item in, item out" principle as a way to reduce clutter, save money, and cultivate a more intentional lifestyle.