Achieving Financial Wellbeing with CedisPay: Two Comprehensive Models to Guide Your Journey

Executive Summary

Achieving financial wellbeing is a journey that requires guidance and the right tools. At CedisPay, we offer two powerful models to support individuals in overcoming financial challenges and improving their overall quality of life. The CedisPay 7 Baby Steps for Wealth Creation provides a straightforward, step-by-step approach to financial stability, while The CedisPay Financial Wellbeing Model offers a comprehensive approach to achieving financial freedom and lasting peace of mind. By choosing the right model, individuals can progress through six levels of financial wellbeing, from financial security to financial peace of mind.

Understanding Financial Challenges

People worldwide face similar financial and lifestyle challenges, including living paycheck to paycheck, high-interest debt, and lack of financial planning. Recognizing these universal issues, CedisPay provides support to overcome them and improve financial wellbeing.

The Six Levels of Financial Wellbeing

-

Financial wellbeing is a state where an individual experiences security, stability, and freedom in their financial life. It means having a stable financial foundation, being able to meet financial obligations, and having the resources to pursue financial goals and enjoy life's experiences. Achieving financial wellbeing involves progressing through several levels:

- Financial Security: Having a stable income, manageable debt, and adequate savings

- Financial Stability: Enjoying a consistent financial situation with minimal financial stress

- Financial Freedom: Having the ability to make choices without financial constraints

- Financial Resilience: Being able to withstand financial shocks and setbacks

- Financial Confidence: Feeling informed and in control of financial decisions

- Financial Peace of Mind: Enjoying a sense of calm and contentment regarding one's financial situation

CedisPay Models for Financial Wellbeing

-

At CedisPay, we firmly believe that financial wellbeing is an ongoing journey rather than a fixed destination. To empower our customers on this path, we offer two robust models:

- The CedisPay Financial Wellbeing Model

- The CedisPay 7 Baby Steps for Wealth Creation Each model is designed to cater to different needs and stages of financial life, ensuring that you have the right tools and guidance no matter where you start. Underlying these models are CedisPay Financial Wellbeing habits, designed to help you thrive financially. Financial health is more than just numbers—it's about creating a system that allows you to live your best life.

Choosing the Right Model for You

The CedisPay 7 Baby Steps: Ideal for those who need a straightforward, step-by-step approach to achieving financial stability. Perfect for those struggling with debt, starting from scratch, or looking for a simple plan.

The CedisPay Financial Wellbeing Model: Suited for those who want a comprehensive approach to financial wellbeing. Ideal for those aiming for financial freedom and peace of mind, and who are willing to make gradual, sustainable changes. This newsletter focuses on helping you choose between the two models and find the one that is appropriate for you.

The CedisPay 7 Baby Steps for Wealth Creation

-

The CedisPay 7 Baby Steps framework is tailored to guide individuals toward financial stability and long-term success. These steps are applicable at any life stage but are particularly effective in the following situations:

- Struggling with Debt: When overwhelmed by debt, the Baby Steps provide a clear, actionable plan to eliminate it.

- Starting from Scratch: If you're just beginning your financial journey, these steps offer a structured path to build a solid foundation

- Experiencing Financial Stress: When financial anxiety is high, the Baby Steps can help regain control and provide peace of mind

- Planning for Big Financial Goals: Whether saving for a home, education, or retirement, these steps ensure you're well-prepared

- Seeking Simplicity: For those tired of complex financial advice, the Baby Steps offer a straightforward, easy-to-follow approach

The CedisPay 7 Baby Steps are

- Have Life Insurance: Ensure your family's financial security in case of unexpected events

- Save $1,000 (North America) or GHS 1,000 (Ghana) as an Emergency Fund: Create a safety net for unforeseen expenses

- Pay Off All Bad Debt Using the Debt Snowball Method: Tackle all bad debt systematically to achieve manageable debt

- Save 3-6 Months of Expenses in a Savings Account: Build a cushion to cover emergencies and job loss.

- Invest 15% of Your Income in Retirement Accounts: Secure your future by building a robust retirement fund.

- Save for College for Your Children: Invest in your children's education to give them a head start.

- Build Wealth and Give Generously: Accumulate wealth and make a positive impact through charitable giving.

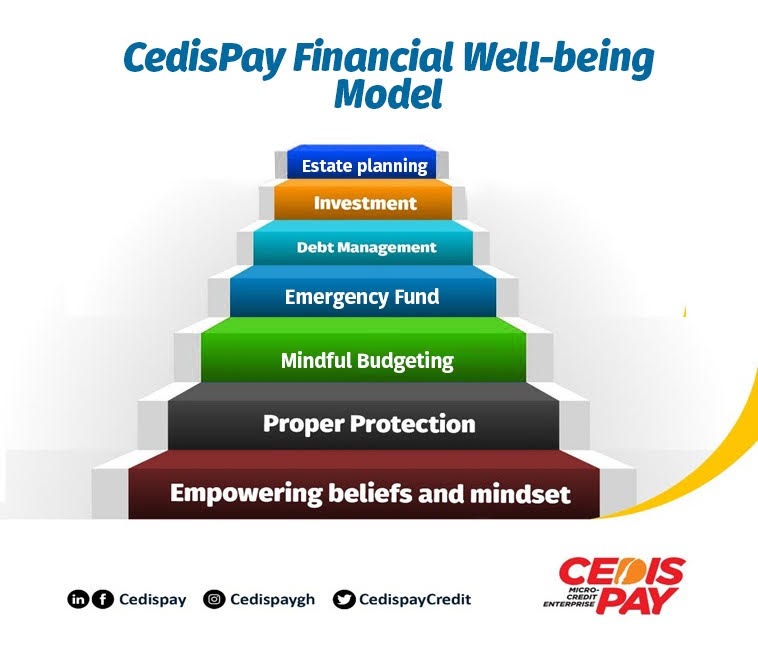

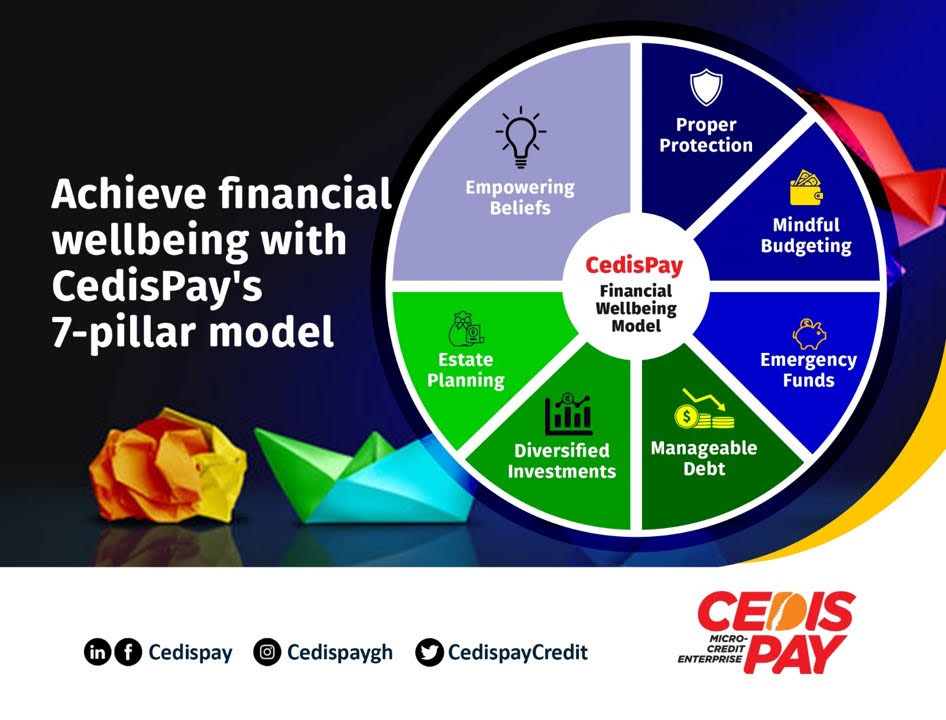

The CedisPay Financial Wellbeing Model

-

The CedisPay Financial Wellbeing Model offers a holistic approach, guiding you towards financial freedom and lasting peace of mind. This model is ideal for those who:

- Seek a Comprehensive Approach: If you want to address all aspects of financial wellbeing systematically

- Desire a Long-Term Plan: Ideal for those looking to create sustainable, long-term financial health

- Aim for Financial Freedom and Peace of Mind: For individuals focused on achieving enduring financial security

- Are Committed to Gradual, Sustainable Changes: Suitable for those ready to make consistent, manageable improvements

The Seven Pillars of the CedisPay Financial Wellbeing Model

- Empowering Beliefs: Foster a positive mindset that supports financial success

- Proper Protection: Ensure adequate insurance coverage to safeguard against risks

- Mindful Budgeting: Manage your finances effectively with careful budgeting

- Emergency Funds: Maintain a reserve for unexpected financial emergencies

- Manageable Debt: Keep debt at manageable levels to avoid financial strain

- Diversified Investments: Grow wealth through a balanced investment portfolio

- Estate Planning: Plan for the future to ensure your assets are distributed as desired

Conclusion

Achieving financial wellbeing is an ongoing journey that requires the right tools and guidance. At CedisPay, we are dedicated to empowering our customers with two distinct models: The CedisPay 7 Baby Steps for Wealth Creation and The CedisPay Financial Wellbeing Model. No matter which model you choose, we are committed to helping you achieve your financial goals and secure a prosperous future. Join us on this journey to financial wellness and take the first step towards a brighter financial future with CedisPay.

-

Reference links:

- The CedisPay Financial Wellbeing Model

- The CedisPay 7 Baby Steps for Wealth Creation

-

Additional Resources:

- Budgeting

- Financial Wellbeing

- Products Resources

- Wealth Making

-

Take the first step towards financial freedom:

- Download our budget template

-

Subscribe to our Newsletters:

- Financial Education

- LinkedIn Newsletter